Opportunities for Photonics companies in ADAS

source:laserfair.com

release:Johnny

Time:2015-06-10

For the last 15 years, Automotive has become an innovative industry. Car manufacturers place innovation as one of the top priorities in their strategy [1]. Their increased interest in new technologiesallowed the release of highly-performant electric vehicles, laser headlamps or parking assistance systems, for example.

The trend toward innovation is a huge opportunity for Photonics companies. Until recently, Photonics was integrated into car only through lighting functions.However, photonic technologies provide critical functions for imaging, sensing, smart displaying or for media communication networks. As a consequence, Photonics is expected to be widely adopted beyond lighting.

EPIC (European Photonics Industry Consortium) recently released a report outlining opportunities for Photonics in the Automotive industry; the report, carried out by Tematys, is focused on Advanced Driver Assistance Systems (ADAS).

Market of Photonics in Automotive

The core business of Photonics in Automotive is and will remain exterior lighting: front and rear headlamps, Daytime Running Lights, brake lights, …Withthe developments of Xenon lamps in the 1990's, the arrival of LEDs in the 2010's and the recent release of laser headlamps for luxury cars, the lighting segment contributes to making automotive an innovative field. Ever since headlamps were made mandatory in the 1930's, the market kept growing and demonstrates today an 8% growth.

Nevertheless, the fastest growing segmentof Photonics in Automotive is the ADAS segment. Indeed, safety of driving has become a major criterion in the car purchasing decision. To answer these requirements, carmakers are developing active safety systems (or ADAS) to complement the existing passive safety systems like seatbelts or airbags. Active safety systems provide functions to prevent accidents: front and rear collision detection,automatic emergency braking systems, adaptive cruise control, lane keeping assist, blind spot detection,etc.

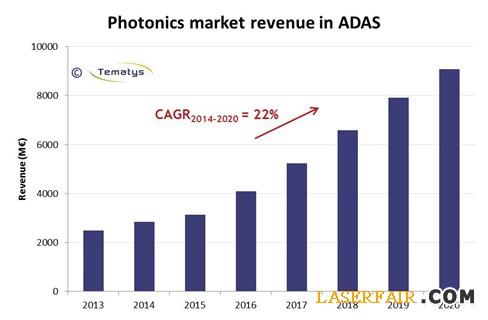

Photonics is an enabler of these functions. For example, sensorslike cameras, LIDARsor night vision systemsare or will be used for obstacles detection while Head-Up Displays (HUD) will be embedded in more and more cars to deliver the relevant information directly in the field-of-view of the driver. That's why, the EPIC-Tematys study expects the market of Photonics in ADAS togrow from around € 2.8b in 2014 to almost € 9 b in 2020 with a CAGR2014-2020 of around 22% [2]. Photonics companies should benefit from this trend.

Opportunities for Photonics companies

Even if lighting is currently the biggest market of Photonics in automotive, it is not the most favorable segment for Photonics companies that would like to enter the automotive market. Indeed, although automotive lighting is an innovative field, the innovation is undertaken by large and well-established companies: Osram, Philipps, Koito Manufacturing, Valeo, Visteon, etc. leaving little space for new comers.

On the contrary, active safety is a relatively new domain and car manufacturers are seeking for breakthrough technologies to provide ever more complex functions to ensure protection of drivers and passengers. Photonic systems are able to fulfill this need for high added-value technologies. ADAS is the entry point for Photonics newcomers in the automotive industry.

Among all photonic-based systems used to enable ADAS functions, the ones that will be widely adoptedin the coming years are those offering an immediate value to the driver. It is the case of Head-Up Displays, for instance. Car manufacturers report a high customer demand for this technology. HUD is a field wher new photonic players can enter. Indeed, original designs are required to reduce size and increase the display area of next generation HUD. Small Photonics companies like Lemoptix(Switzerland) or TwoTrees Photonics (UK) have developed new designs based on laser scanning microprojection or holography that attracted the automotive industry. They are now collaborating with automotive industry players.

Other technologies that are expected to massively enter the car are vision and sensing systems to sense the car environment and detect hazardous situations.In Photonics, many research and developmentsare undertaken in the field of cameras and LIDARsto improve systems performance and decrease costs.

Cameras have started to be embedded in cars for few years and are expected to be more and more adopted due to customer demand and regulations. It is a great opportunity for camera manufacturers that wish to diversify into the automotive field. Due to high costs and maintenance issues, the adoption path for LIDARs will be longer. However, carmakers expect 3D mapping LIDARS to evolve rapidly and toinitiate the way towards autonomous driving. Photonic companies like Velodyne(USA) or Ibeo (Germany)are taking advantage of this trend and are developing LIDAR to map the car surroundings at 360° in 3D.

Photonics has a bright future in Automotive, especially in ADAS wher the strong demand for reliable, high added value and cost-effective technologies will open the road for newcomers from the Photonics industry. However, even ifcarmakers or Tier 1 suppliers are sourcing groundbreaking ideas and concepts among innovative Photonics companies, the technology production is generally undertaken by large companies already involved in the automotive industry and used to high volumes and constraints of car manufacturing.

Figure. Photonics market revenue in ADAS from 2013 to 2020 in M€

Authors

ClémentineBouyé, analyst at Tematys

Jacques Cochard, partner, Tematys

Carlos Lee, Director General, EPIC – European Photonics Industry Consortium

References

[1] "The most innovative companies 2013", Boston Consulting Group

[2] Tematys, EPIC, "Photonics Technologies for ADAS in the Automotive Industry - Needs, Challenges, Market Forecasts", March 2015.

- RoboSense is to Produce the First Chinese Multi-beam LiDAR

- China is to Accelerate the Development of Laser Hardening Application

- Han’s Laser Buys Canadian Fiber Specialist CorActive

- SPI Lasers continues it expansion in China, appointing a dedicated Sales Director

- Laser Coating Removal Robot for Aircraft

FISBA exhibits Customized Solutions for Minimally Invasive Medical Endoscopic Devices at COMPAMED in

FISBA exhibits Customized Solutions for Minimally Invasive Medical Endoscopic Devices at COMPAMED in New Active Alignment System for the Coupling of Photonic Structures to Fiber Arrays

New Active Alignment System for the Coupling of Photonic Structures to Fiber Arrays A new industrial compression module by Amplitude

A new industrial compression module by Amplitude Menhir Photonics Introduces the MENHIR-1550 The Industry's First Turnkey Femtosecond Laser of

Menhir Photonics Introduces the MENHIR-1550 The Industry's First Turnkey Femtosecond Laser of Shenzhen DNE Laser introduced new generation D-FAST cutting machine (12000 W)

more>>

Shenzhen DNE Laser introduced new generation D-FAST cutting machine (12000 W)

more>>